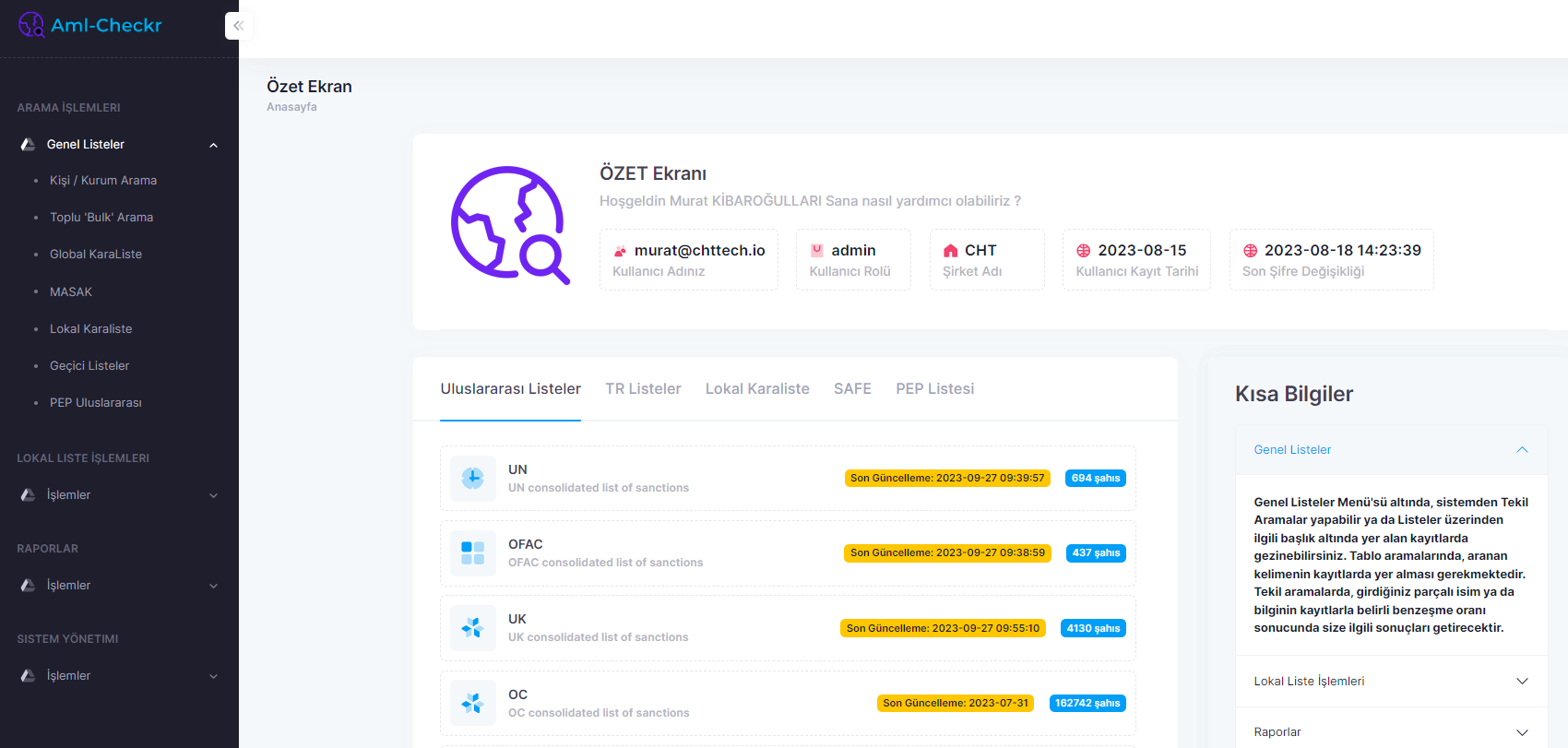

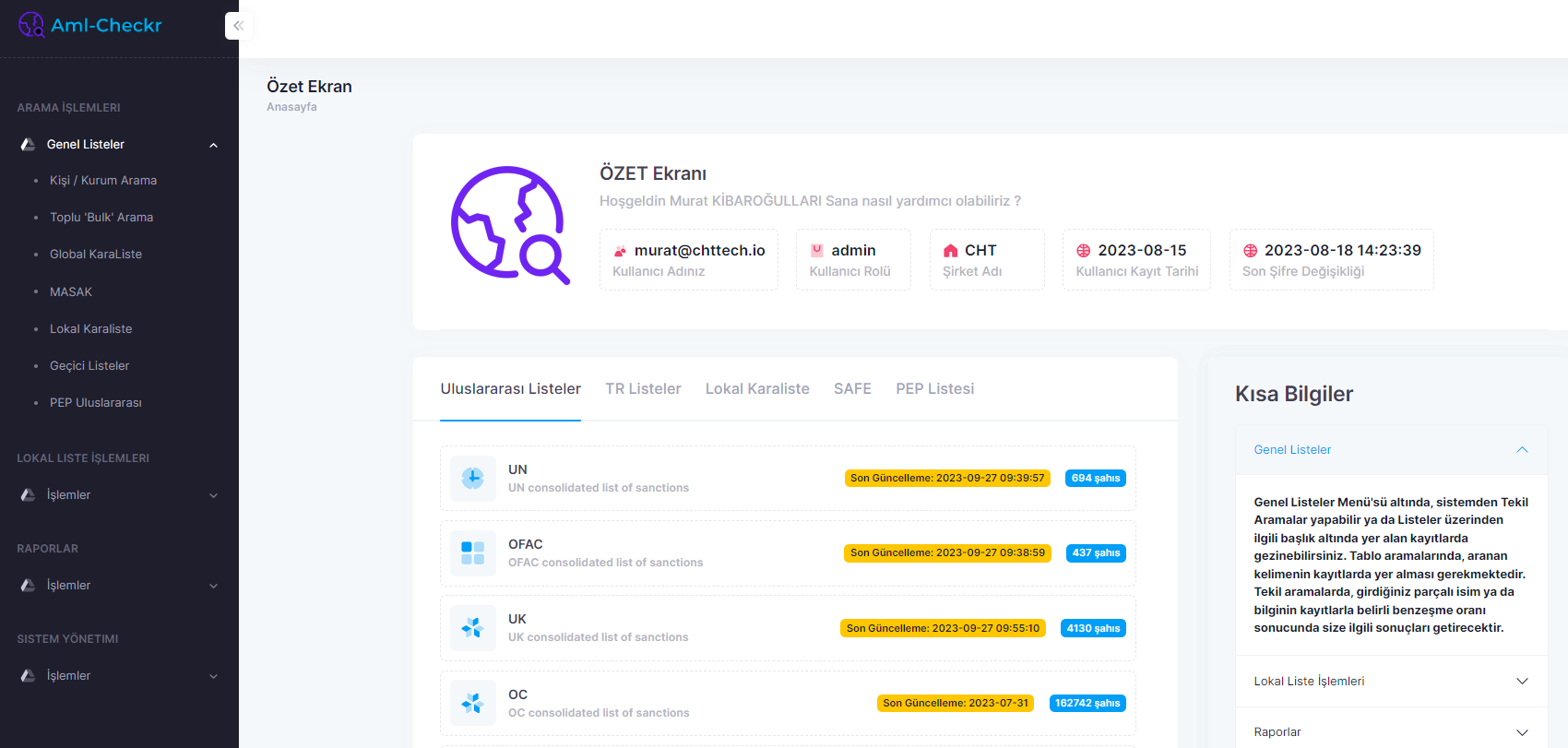

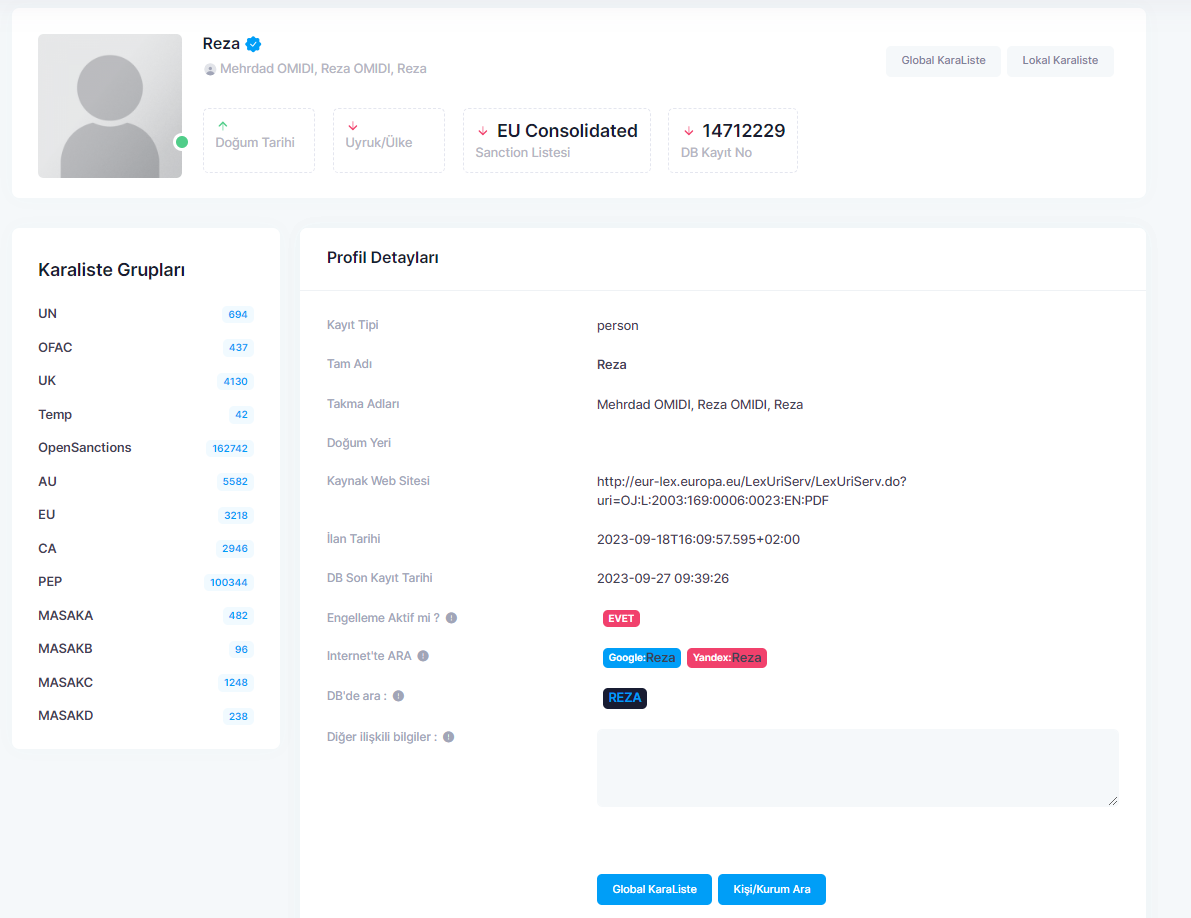

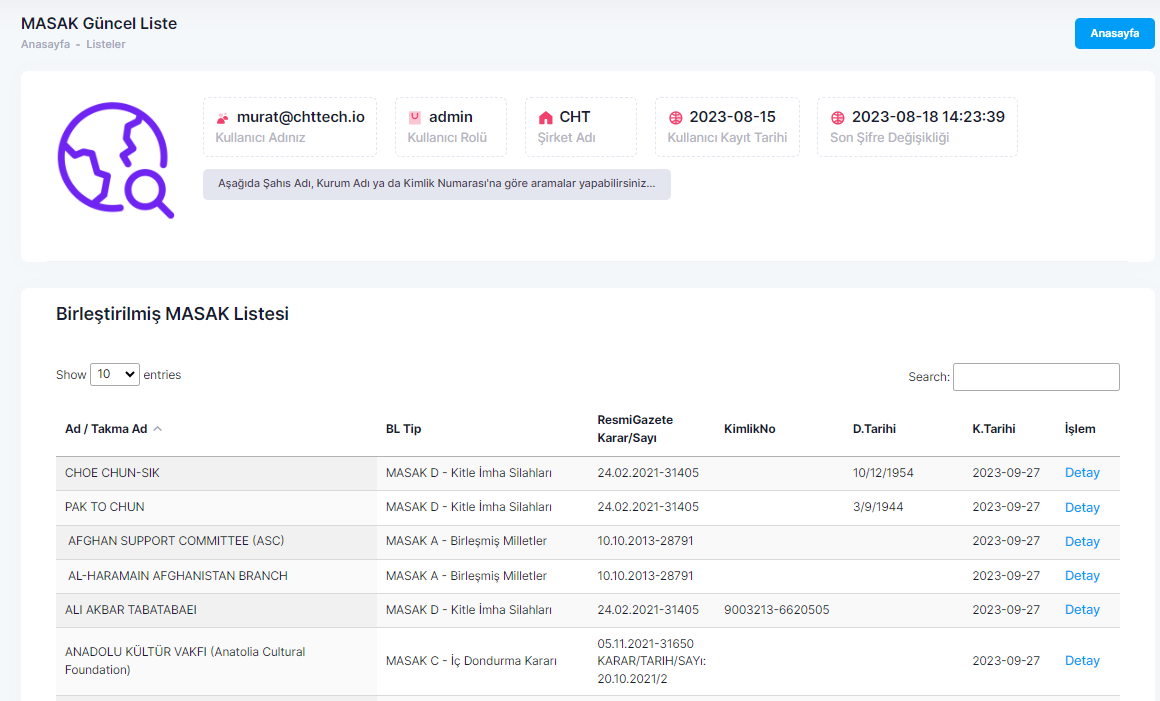

You can create an AML Control Program when you first open an account to a customer based on their risk levels by scanning them in thousands Global Sanctions lists, PEPs Lists, and Adverse Media Data updated every minute.

Prevent money laundering by screening against PEPs, sanctions, and adverse media using watchlists, ensuring stringent AML compliance.

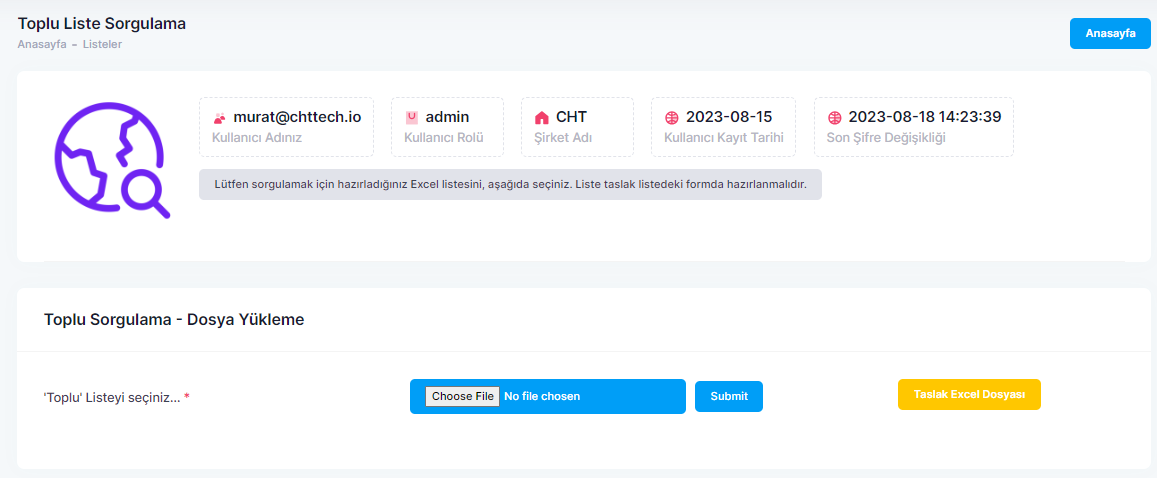

You can integrate AML-checkr into your project within a day. It supports all the features of our API/AML solutions. We automate your business' AML Control Processes with a powerful API and reduce your workload.

Integrate AML-checkr into your project with API within hours.

Trusted Clients

Our AML solution performs individual and business screening against global AML databases seconds. The process identifies high-risk entities in real-time by leveraging advanced technologies and human intelligence to deliver highly accurate results.

For AML-checkr, with zero maintenance downtime

Scan for hundres of countries for customer and business screening.

Screen potential clients against thousands global AML wathclists.

Updated lists in every 15 minutes.

"AML-checkr's solution helped us screen our customers against global sanction, watchlists and adverse media databases issued by OFAC, FATF, MASAK and many others."

AML-checkr organises sanctions and PEP screening lists by region, country and regulation

AML was created to prevent and combat money laundering and the financing of terrorism. The aim is to safeguard the integrity of the financial sectors. Organisations that are subject to AML must assess and record the risks of money laundering and terrorist financing. This has direct consequences for the Customer Due Diligence that must take place.

If you are subject to the AML, a Customer Due Diligence (CDD) check of your clients is mandatory. This check is based on the KYC policy. What exactly needs to be done is described in the AML. The reason for screening your clients is to map the risks that you take when accepting new clients. Are there any signs of money laundering and terrorist financing, or are you identifying any suspicious transactions? Then you must report this. The extent of the investigation depends on the risk sensitivity. Conducting a sound KYC policy leads to carefree and responsible entrepreneurship.

Here you will find the current overview of reporting institutions:

For the AML, the following is mandatory::

From customer onboarding to audits and compliance, fintech companies and banks around the world use AML-checkr to comply with the regulations.

Get started

Do you have any questions, or would you like to receive appropriate advice?